پترودولار

الپترودولار Petrodollar، يشير إلى الدولارات الأمريكية المجنية عن طريق تصدير النفط. It generally refers to the phenomenon of major petroleum-exporting nations, mainly the OPEC members plus Russia and Norway, earning more money from the export of crude oil than they could efficiently invest in their own economies. The resulting global interdependencies and financial flows, from oil producers back to oil consumers, can reach a scale of hundreds of billions of US dollars per year – including a wide range of transactions in a variety of currencies, some pegged to the US dollar and some not. These flows are heavily influenced by government-level decisions regarding international investment and aid, with important consequences for both global finance and petroleum politics. The phenomenon is most pronounced during periods when the price of oil is historically high. The first major petrodollar surge (1974–1981) resulted in more financial complications than the second (2005–2014).

الأصول

في إطار الجهود المبذولة لحمل قيمة الدولار، تفاوض ريتشارد نيكسون حول اتفاقية مع السعودية أنه في لقاء الأسلحة والحماية يتم إدراج جميع مبيعات النفط المستقبلية بالدولار. بالتالي، وافقت جميع بلدان الاوپك على اتفاقيات مماثلة مما عمل على ضمان الطلب العالم على الدولار الأمريكي وسمح للولايات المتحدة بتصدير بعض التضخم الذي تعاني منه.[] ولأن هذه الدولار لا تدور داخل البلاد فهي بالتالي ليست جزءاً من الإمداد النقدي الطبيعي، مما دفع بعض الاقتصاديين بالشعور بالاحتياج إلى مصطلح آخر لوصف الدولارات التي تُجنى من البلدان المصدرة للنفط (الاوپك) لقاء النفط، لذا فقد قام ابراهيم عويس، أستاذ الاقتصاد في جامعة جورجتاون بصياغة مصطلح الپترودولار.

ولأن الولايات المحدة كانت ثاني أكبر منتج ومستهلك للنفط في العالم، يتم تسعير سوق النفط العالمي بالدولار الأمريكي منذ نهاية الحرب العالمية الثانية. تعتمد أسعار النفط الدولي على الخصومات أوفروق القيمة المتعلقة بهذا النفط في خليج المكسيك. لكن، وعلى الرغم من حتى مبيعات النفط قبل 1973 كانت بالدولار الأمريكي، إلا أنه ليس هناك ما يمنع من تسويتها بالعملة المحلية.

في أكتوبر 1973، أعربت دول الاوپك حظر النفط رداً على دعم الولايات المتحدة وأوروپا الغربية لإسرائيل في حرب أكتوبر، وأدى هذا التوتر (والقوى الجديدة للاوپك) إلى الخوف من حتى يصبح الدولار غير فعال في تجارة النفط.

التأثير المالي

التدفقات الضخمة للپترودولار إلى البلاد عادة ماقد يكون له أثراً على قيمة عملتها. بالنسبة لكندا اتضح حتى زيادة 10% في ثمن النفط أدى إلى زيادة قيمة الدولار الكندي لقاء الدولار الأمريكي بنسبة 3%. والعكس سليم.

معاني بديلة

بالإضافة إلى الپترودولار الأمريكي، قد يشير الپترودولار أيضاً إلى الدولار الكندي في المعاملات المالية التي تتضمن بيع النفط الكندي لدول أخرى.

في هذا الإطار، فإن مصطلح الپترودولار يرتبط لكن لا يتوجب الخلط بينه وبين پتروكرنسي والذي يشير إلى العملة الوطنية العملية لكل بلد مصدر للنفط.

Capital flows

Background

Especially during the years 1974–1981 and 2005–2014, oil exporters amassed large surpluses of "petrodollars" from historically expensive oil. (The word has been credited alternately to Egyptian-American economist Ibrahim Oweiss and to former US Secretary of Commerce Peter G. Peterson, both in 1973.) These petrodollar surpluses could be described as net US dollar-equivalents earned from the export of petroleum, in excess of the internal development needs of the exporting nations. The surpluses could not be efficiently invested in their own economies, due to small populations or being at early stages of industrialization; but the surpluses could be usefully invested in other nations, or spent on imports such as consumer products, construction supplies, and military equipment. Alternatively, global economic growth would have suffered if that money was withdrawn from the world economy, while the oil-exporting nations needed to be able to invest profitably to raise their long-term standards of living.

1974–1981 surge

2005–2014 surge

المعونات الأجنبية

Oil-exporting countries have used part of their petrodollar surpluses to fund foreign aid programs, as a prominent example of so-called "checkbook diplomacy" or "petro-Islam". The Kuwait Fund was an early leader since 1961, and certain Arab nations became some of the largest donors in the years since 1974, including through the IMF and the OPEC Fund for International Development. Oil exporters have also aided poorer nations indirectly through the personal remittances sent home by tens of millions of foreign workers in the Middle East, although their working conditions are generally harsh. Even more controversially, several oil exporters have been major financial supporters of armed groups challenging the governments of other countries.

High-priced oil allowed the USSR to support the struggling economies of the Soviet bloc during the 1974–1981 petrodollar surge, and the loss of income during the 1980s oil glut contributed to the bloc's collapse in 1989. During the 2005–2014 petrodollar surge, OPEC member Venezuela played a similar role supporting Cuba and other regional allies, before the 2014–2017 oil downturn brought Venezuela to its own economic crisis.

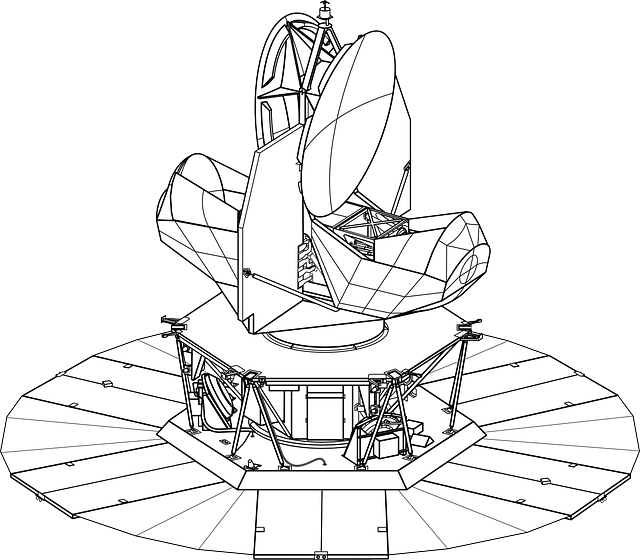

Gallery of notable examples

These images illustrate the diversity of major petrodollar recycling activities, in roughly chronological order:

US Treasury securities, approximately $300 billion accumulated by OPEC governments during 1960–2015

German vehicle factory for Daimler, whose largest consistent shareholder since 1974 has been Kuwait

Itaipu Dam between Brazil and Paraguay, financed by loans from petrodollar bank deposits in the 1970s[]

Pakistan's Faisal Mosque, constructed 1976–1986, a gift from Saudi Arabia's King Faisal

Western grain, heavily imported by the Soviet Union to ease food shortages in the 1970s and 1980s

American-built F-15 fighter jet, one of dozens owned by the Royal Saudi Air Force since 1981

Harrods department store in London, under Arab ownership since 1985

London's Chelsea Football Club, Russian-owned since 2003 through the Sibneft oil fortune

"Oil for doctors" program, with thousands of Cuban physicians anchoring the Venezuelan health system from 2004

Bottles of premium French wine, millions of which were purchased by Dubai-owned Emirates airline since 2005

Turkish Telecom Corp., whose control was privatized to the Saudi Oger organization in 2005 with IMF support

New York's Chrysler Building, 90% owned by the Abu Dhabi Investment Council since 2008

Iranian weapon shipments to Lebanon and Syria, including over 300 tons intercepted in 2009

Cézanne painting, purchased in 2011 by the Royal Family of Qatar for a record-setting price above US$250 million

UAE construction boom during 2003–2014, primarily built by imported foreign workers and contractors

Toyota vehicles in Kuwait, where the Japanese automaker holds a dominant market share

انظر أيضاً

- پترو

- پتروكرنسي

- اعادة تدوير الپترودولار

- پتروبورس

- پترويورو

- سياسات النفط

- هيمنة نقدية

- انهيار نظام برتون وودز

- صدمة نيكسون

الهامش

- ^ "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. January 10, 2006. Archived from the original on January 7, 2008. CS1 maint: unfit url (link)

- ^ "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. May 15, 2017. Retrieved May 28, 2017.

- ^ The Petrodollar

- ^ Nsouli, Saleh M. (March 23, 2006). "Petrodollar Recycling and Global Imbalances". International Monetary Fund. Retrieved January 14, 2017.

- ^ The Oil Kings: How Nixon courted the shah.

- ^ Hamilton, James D. Historical Oil Shocks. Department of Economics. University of California, San Diego. Revised: February 1, 2011

- ^ Adelman, M. A. (1972). The World Petroleum Market, Baltimore: Johns Hopkins University Press, Chapter5.

- ^ Correlation between the oil prices and the Canadian dollar

- ^ "Petrodollar Profusion". The Economist. April 28, 2012. Retrieved February 7, 2016.

-

^ "Personality: Ibrahim M. Oweiss". Washington Report on Middle East Affairs. December 26, 1983. p. 8. Retrieved January 11, 2017.

In March 1973... Two weeks after Dr. Oweiss had used the word – at an international monetary seminar held at Columbia University's Arden House in Harriman, New York – it was picked up by a prestigious economics commentator in The New York Times.

According to the Oweiss and NYT websites, it appears that these events actually occurred in March 1974. -

^ Rowen, Hobart (July 9, 1973). "Peterson Urges Cooperation". The Washington Post. p. A1. Retrieved February 5, 2016.

He thinks the U.S. should give more study to ways in which the excess funds – he calls them petro dollars – can be soaked up.

-

^ Popik, Barry (February 1, 2012). "Petrodollar". Retrieved January 11, 2017.

Georgetown University economics professor Ibrahim Oweiss has written about petrodollars and is credited with the word's coinage by Wikipedia, but there is insufficient documentary evidence that he used the term first in 1973. Former commerce secretary Peter G. Peterson was credited with using 'petrodollar' in a July 1973 Washington Post article.

- ^ خطأ استشهاد: وسم

<ref>غير سليم؛ لا نص تم توفيره للمراجع المسماةOweiss - ^ "Petrodollar Problem". International Monetary Fund. Retrieved January 31, 2016.

- ^ "Federal Reserve Economic Data graph". Federal Reserve Bank of St. Louis. Retrieved August 25, 2016.

- ^ "Timeline". Kuwait Fund. Retrieved January 22, 2017.

- ^ Hubbard, Ben (June 21, 2015). "Cables Released by WikiLeaks Reveal Saudis' Checkbook Diplomacy". The New York Times. Retrieved February 16, 2016.

- ^ Mukherjee, Andy (February 4, 2016). "Oil's Plunge Spills Over". Bloomberg News. Retrieved February 4, 2016.

- ^ Davis, Mike (September – October 2006). "Fear and Money in Dubai". New Left Review (41). Retrieved February 12, 2016.

Dubai is capitalized just as much on cheap labour as it is on expensive oil, and the Maktoums, like their cousins in the other emirates, are exquisitely aware that they reign over a kingdom built on the backs of a South Asian workforce.

- ^ ". Associated Press. October 27, 2008. Retrieved March 29, 2017.

- ^ Weinberg, Leonard; Martin, Susanne (2016). . Oxford University Press. "Libya", pp. 207–208. ISBN . Retrieved March 29, 2017.

- ^ Cockburn, Patrick (October 14, 2016). "US allies Saudi Arabia and Qatar are funding ISIS". The Independent. Retrieved March 29, 2017.

- ^ Pacepa, Ion Mihai (August 24, 2006). "Russian Footprints". National Review. Archived from the original on January 9, 2015.

-

^ McMaken, Ryan (November 7, 2014). "The Economics Behind the Fall of the Berlin Wall". Mises Institute. Retrieved January 12, 2016.

High oil prices in the 1970s propped up the regime so well, that had it not been for Soviet oil sales, it's quite possible the regime would have collapsed a decade earlier.

- ^ Gibbs, Stephen (August 24, 2005). "Venezuela ends upbeat Cuba visit". BBC. Retrieved November 28, 2016.

- ^ Polanco, Anggy (July 17, 2016). "Venezuelan shoppers flock across border to Colombia". Reuters. Retrieved December 31, 2016.

- ^ "Major Foreign Holders of Treasury Securities". U.S. Department of the Treasury. December 15, 2015. Archived from the original on January 3, 2016. CS1 maint: unfit url (link)

-

^ Taylor, Edward (September 18, 2014). "Kuwait Investment Authority says to expand Germany investments". Reuters. Retrieved January 17, 2017.

The KIA... is the largest shareholder in Daimler.

-

^ Al Saleh, Anas K. (September 18, 2014). "KIA/Daimler 40th Anniversary Celebrations" (PDF). Kuwait Investment Authority. Retrieved January 17, 2017.

From a 14.6% stake of around US$329 million acquisition in December 1974, the KIA is now the largest consistent shareholder in Daimler over 40 years where our 6.9% stake is currently valued around $7 billion.

-

^ Castor, Belmiro V.J. (2003). (English, 2nd ed.). Xlibris. p. 202. ISBN . Retrieved January 18, 2017.

International bankers... began to invest huge amounts of those petro-dollars in Brazil and other developing countries..., allowing them to finance gigantic infrastructure works like the Itaipu Hydroelectric Plant.

-

^ "Shah Faisal Mosque". Lonely Planet. Retrieved March 29, 2017.

Most of its cost (pegged at about US$120 million today) was a gift from King Faisal of Saudi Arabia.

-

^ Zubok, Vyadislav M. (2010). "Soviet foreign policy from détente to Gorbachev, 1975–1985". In Leffler, Melvyn P.; Westad, Odd Arne (eds.). . Cambridge University Press. pp. 109–110. ISBN . Retrieved January 18, 2017.

The former head of the Soviet planning agency, Nikolai Baibakov, recalled that 'what we got for oil and gas' was $15 billion in 1976–80 and $35 billion in 1981–85. Of this money, the Soviets spent, respectively, $14 billion and $26.3 billion to buy grain, both to feed the cattle on collective farms and to put bread on the tables of Soviet citizens.

-

^ Mohr, Charles (August 22, 1981). "Saudi AWACS Deal Passes $8 Billion". The New York Times. Retrieved November 5, 2016.

The price of the arms sale gives increased weight to an argument that in part it should be approved because it helps to 'recycle petrodollars'.

-

^ Feder, Barnaby J. (September 8, 1985). "Harrod's New Owner: Mohamed al-Fayed; A Quiet Acquisitor Is Caught in a Cross Fire". The New York Times. Retrieved January 16, 2017.

This was a dream come true for the family, which built its fortune... first in the oil-rich countries of the Persian Gulf.

- ^ "Mohammed Fayed sells Harrods store to Qatar Holdings". BBC. May 8, 2010. Retrieved February 7, 2016.

- ^ "Russian businessman buys Chelsea". BBC. July 2, 2003. Retrieved March 23, 2016.

-

^ Critchley, Mark (April 12, 2015). "Roman Abramovich reaches 700 games as Chelsea owner – but how does his reign stack up against the rest?". The Independent. Retrieved August 1, 2016.

Since the Russian oligarch began pouring petro-dollars into Stamford Bridge, he has turned one of English football's underachieving clubs into an established powerhouse.

-

^ Delaney, Miguel (February 2, 2014). "The colossal wealth of Manchester City and Chelsea is changing the landscape of British football". The Sunday Mirror. Retrieved August 1, 2016.

It should not escape notice that this is the first true title showdown, and first genuine title race, between the petrodollar clubs.

-

^ Corrales, Javier (December 2005). "The Logic of Extremism: How Chávez Gains by Giving Cuba So Much" (PDF). Inter-American Dialogue. Retrieved November 29, 2016.

In return for oil, Cuba is sending Venezuela between 30,000 and 50,000 technical staff. As many as 30,000 Cubans in Venezuela are presumably medical doctors.

-

^ Gaddy, James (January 5, 2017). "Emirates Has Invested $500 Million to Build a 'Fort Knox' of Wine". Bloomberg News. Retrieved January 5, 2017.

Since the Dubai-based airline began its wine program 12 years ago, it has spent more than $500 million to develop the best wine list in the sky... 'It’s an investment. We look at it like a commodity.'

-

^ Aydogdu, Hatice (November 15, 2005). "Oger Telecom signs $6.55 bln Turk Telekom deal". Reuters. Archived from the original on February 2, 2017. Retrieved January 30, 2017.

'... a long-term investment, not only in the future of Turk Telekom but also in Turkey,' Hariri said. The sale of Turk Telekom's controlling stake is a key element of Turkey's IMF-backed privatization program.

-

^ Thomas, Landon, Jr. (July 9, 2008). "Abu Dhabi buys 75% of Chrysler Building in latest trophy purchase". The New York Times. Retrieved December 29, 2016.

These funds, which maintain passive investment positions, will perform a crucial petrodollar-recycling function.

- ^ Bagli, Charles V. (July 10, 2008). "Abu Dhabi Buys 90% Stake in Chrysler Building". The New York Times. Retrieved July 3, 2016.

-

^ Lynch, Colum (December 11, 2009). "U.N. panel voices concern over Iran's apparent violations of arms-export embargo". The Washington Post. Retrieved March 29, 2017.

A U.N. sanctions committee expressed 'grave concern' Thursday about what it called apparent Iranian violations of a U.N. ban on arms exports.

-

^ Harel, Amos; Stern, Yoav (August 4, 2006). "Iranian Official Admits Tehran Supplied Missiles to Hezbollah". Haaretz. Retrieved March 29, 2017.

Mohtashami Pur, a one-time ambassador to Lebanon who currently holds the title of secretary-general of the 'Intifada conference', told an Iranian newspaper that Iran transferred the missiles to the Shi'ite militia.

-

^ Peers, Alexandra (February 2012). for More Than $250 Million, Highest Price Ever for a Work of Art". Vanity Fair. Retrieved February 19, 2016.

The money is there: the United Arab Emirates region is home to nearlyعشرة percent of all the world's oil reserve.

-

^ Business Monitor International (March 2016). "Q2 2016". Kuwait Autos Report. Retrieved January 13, 2017.

In 2015, Japanese carmaker Toyota retained its long-held local market leadership..., over three times its nearest rival Nissan.

للاستزادة

- Clark, William R. (2005). Petrodollar Warfare. New Society Publishers. ISBN .

- Smolyar, Leonid (2006). (PDF) (B.Sc. Honors thesis). New York University. Archived from the original (PDF) on April 25, 2012.

- Staats, Elmer B. (1979). "The U.S.–Saudi Arabian Joint Commission on Economic Cooperation". U.S. Government Accountability Office. Retrieved January 31, 2016.